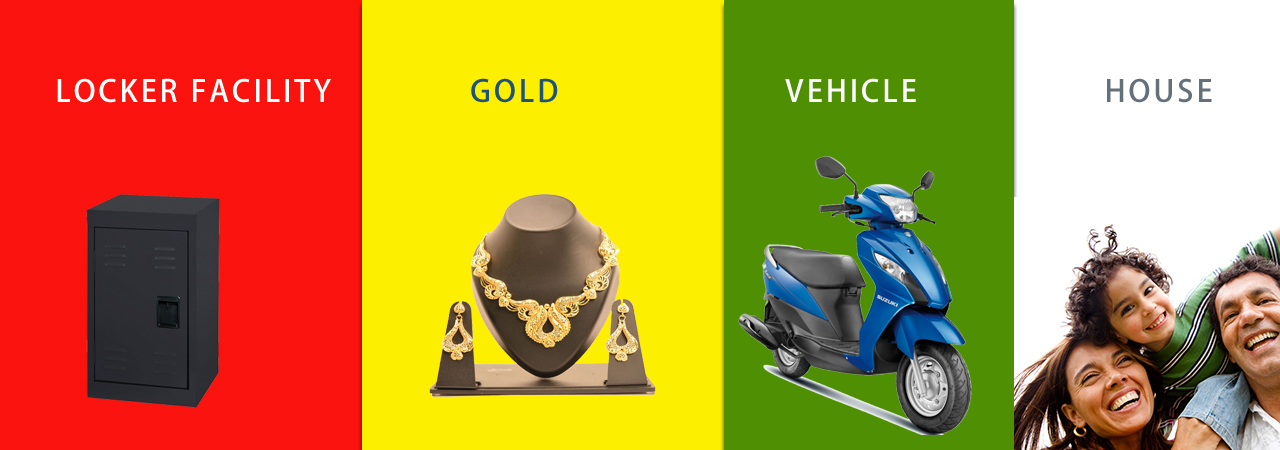

Personal Loan: 16.50%

Type of Customer: Individuals:

Limits of Loans: Maximum Rs. 1.00 lacs .

Documents Required: Salary slip, Last 6 months bank statements, 3 blank cheques, and Surety of Government employee.

Gold Loan: 11.5% P.A

Type of Customer: Individuals

Limits of Loans: Maximum Rs. 5.00 lacs for depending on the repaying capacity and existing banking relations.

Basis of Advance/ Eligibility: 65%-70% of valuation. Valuation should be done by banks approved valuer.

Repayment Period: Maximum repayment period is 12 months

Shareholding: Regular Membership.

Disbursement of Loan: Loan shall be disbursed on the same day of Valuation.

Rate Of Interest: 11.5% P.A.

Vehicle Loan: 14% P.A

- Loan available for purchasing new and used four wheeler vehicles and Two wheeler vehicles for own used and commercial purpose.

- Rate of Interest 14% P.A

Housing Loan :

- Home loans are available for purchasing new residential house/ flat or for construction of house/bungalow or for taking over home loan from other institution

- Maximum amount Rs.50 Lakhs

- Rate of interest, For construction of house or flats purchase – 14%

- Rate of interest, For Site purchase – 15%

- Mortgage loan 16%.